The Audit Log – Q3 2025

The Audit Log is Parcha's quarterly newsletter sharing our latest product and company updates. In this edition, we officially launch Agent Hub, ship document verification and UBO screening in Parcha 2.1, and cover the latest product updates from the last quarter.

Please don't forget to subscribe below if you haven't already!

Product Updates from Q3

Let's kick off with some exciting product updates! It's been a busy quarter here at Parcha. Here's what's new...

🚀 Introducting Agent Hub

In Q3 we officially launched Agent Hub which is now available to all compliance teams.

Agent Hub is a platform that enables compliance teams to create, customize, and deploy AI agents in minutes, not days or weeks.

With Agent Hub, compliance teams can:

- Choose from over a dozen preconfigured AI Agents for customer onboarding, enhanced due diligence, AML screening, merchant categorization, vendor due diligence and much more.

- Quickly customize the AI agent to match existing processes and risk frameworks.

- Start testing an AI agent in minutes with sample datasets or by simply uploading a CSV file.

Since launching in July, we've seen strong early traction with compliance teams able to go from demo to running their first cases in under 15 minutes – no weeks-long integration required.

If you would like to supercharge your compliance team with AI agents, schedule a 15-minute tour and get onboarded by our team, or get started with 1,000 free Agent Hub credits on us:

Customizable Document Verification

We completely rebuilt document verification from the ground up. Now in Agent Hub, you can pick and choose exactly which documents to include in your KYB workflow. Need incorporation documents but not EIN verification? Want source of funds but not proof of address? Just toggle what you need.

Here's what you can now add to any KYB agent:

Incorporation Document Verification:

- Support for incorporation documents from any jurisdiction globally

- Visual verification for all 50 US states, France, Hong Kong, and 11 Eastern European countries (LT, BG, HR, CZ, EE, HU, LV, PL, RO, SK, SI)

- Automated extraction of key business details like registration numbers, dates, and entity status

Additional Verification Options:

- EIN verification with automated tax ID verification for US businesses

- Business proof of address with enhanced location verification to determine if the address isn't a P.O. Box, registered agent or law firm

- Source of funds verification for advanced financial document analysis to determine if source of funds meets a specific threshold

- Business ownership document verification that can verify which business owners meet a specific ownership percentage

What makes Parcha's document verification unique:

Parcha's document verification process uses a combination of OCR, multimodal AI and ML models to verify documents are the correct format, make sure the extracted data matches the associated business and that the document has not been tampered with. Each document verification in Agent Hub is configurable to select exactly what to extract and verify to meet your specific requirements.

And with the upgraded document viewer, you get a complete view of the document, the AI's reasoning, and exactly what passed or failed.

How to get started with document verifications:

You can start verifying documents in Agent Hub by selecting an agent template that includes documents or adding a document verification step when customizing your agent.

Learn more about how Parcha's document verification system works here.

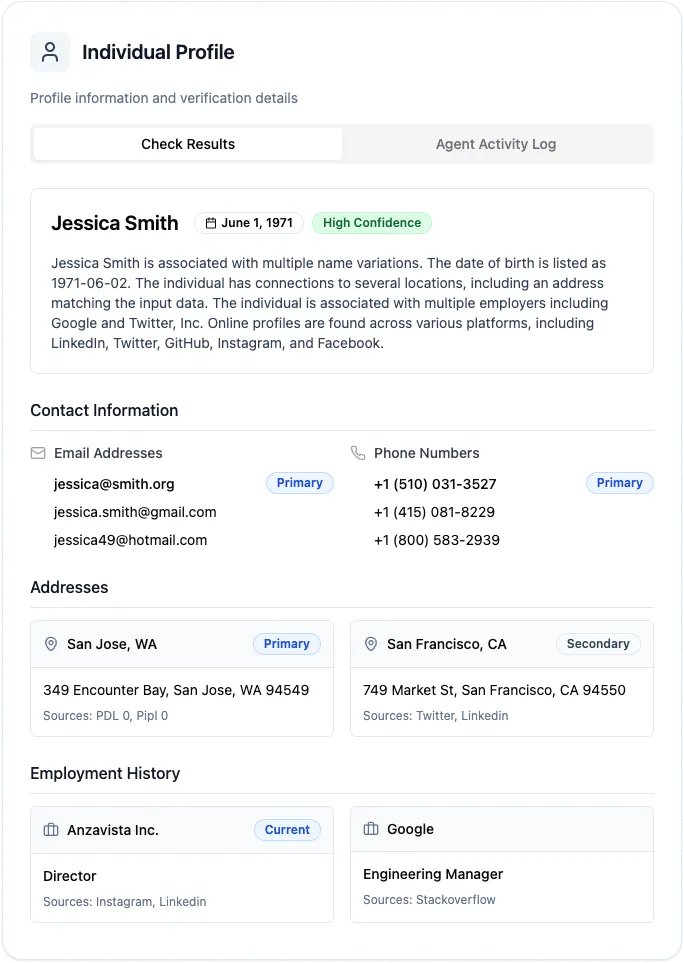

KYC for UBOs as Part of Your KYB Process

One of the most widely requested features: automatic KYC screening for Ultimate Beneficial Owners during business verification.

Now you can. When you run KYB verification, you can automatically trigger individual KYC screening for all the UBOs we identify. This means full AML screening, sanctions checks, and web presence analysis for every person who owns 25% or more of the business - all in one workflow.

This isn't just convenient, it's how compliance actually works in the real world. You don't verify businesses and individuals separately. You verify businesses, then you verify the people who own them.

Agentic Deep Research for Individuals

We've supercharged individual research with tools that actually think like a human investigator. The Individual Web Presence Research Tool doesn't just search for someone's LinkedIn profile and call it done. It builds a comprehensive picture:

- Cross-references multiple data sources (PDL, Pipl, and web research)

- Analyzes career history and validates employment claims

- Assesses location consistency across different profiles

- Generates match strength scores based on comprehensive identity verification

The AI can spot inconsistencies that would take a human hours to find. Like when someone claims to work at a company in New York but their phone number is registered in Florida and their social media shows them consistently posting from Texas.

The Little Things That Make a Big Difference

Sometimes the most important improvements are the ones that save you 30 seconds, 50 times a day:

- Bulk Operations: Delete multiple failed cases at once instead of clicking through them one by one

- Full-Width Case Tables: We expanded the cases overview to use the full screen width. More data visible, less scrolling

- Improved CSV Import: Batch imports now properly redirect to your cases table and show results immediately. No more refreshing to see if your upload worked

- Enhanced Location Matching: Added option to select "None" for location matching requirements, giving you more flexibility in screening configurations

We've also squashed 20+ bugs that were slowing you down including:

- Fixed cases disappearing after submission in AML screening

- Resolved PDF preview loading indefinitely in document flyouts

- Eliminated conflicting results between reports and verification details

- Fixed API key access issues for admin users

- Standardized step naming across all templates

- Corrected cost display for complex agent configurations

- Resolved CSV import workflow issues

- Fixed web presence data inconsistencies across UI components

- Eliminated duplicate steps appearing in template configurations

- Fixed analysis depth controls not appearing properly

- Made age threshold slider consistent across all KYC AML screening steps

- Active agent in your sidebar now automatically scrolls into view

The theme across all these fixes? Making sure the AI gives you consistent, reliable results that you can trust when making compliance decisions.

If you want a tour of the latest Parcha features, schedule a demo with us below!

🤝 Customer Spotlight: Pipe

Last year, global embedded finance platform Pipe approached us with a challenge: they needed help reducing the manual due diligence their fraud and compliance teams were doing to verify businesses they were underwriting. Many of the companies had limited to no web presence, besides their social media pages and online reviews.

This was a perfect use case for our enhanced due diligence agent, which can conduct in-depth research on any business, even when a website isn't provided. We partnered with Alloy to provide a customized version of our agent that is integrated directly into Pipe's Alloy workflow. Parcha’s AI agent now accelerates fraud and compliance processes across Pipe’s business.

"In fintech, speed is everything. But only if you can move fast safely. Our small business customers need capital fast, and we need to move just as quickly on fraud & compliance. Parcha's AI agent for deep business due diligence let us accelerate our fraud & compliance processes without compromising quality, which is exactly what we need to scale rapidly across multiple markets." — Luke Voiles, CEO of Pipe

If you are interested in learning more about using Parcha in your Alloy workflows, please reach out to your Alloy account manager or contact us directly.

News and Events

The latest news and events from Parcha...

📝 New Blog Series: The Compliance Arms Race

This quarter we published a new series on agentic AI for compliance – The Compliance Arms Race. In this series, we explore how agentic AI is transforming the way compliance teams operate and why it differs from traditional AI solutions.

You can read the first four parts here:

- Part 1: Why Agentic AI Is Now a Necessity, Not a Nice-to-Have

- Part 2: Why traditional AI failed compliance teams

- Part 3: What makes agentic AI different

- Part 4: Built with guardrails for compliance

🎤 From Slackbot to $1B Exit: Fireside chat on scaling stablecoins with Zach Abrams, CEO of Bridge.xyz

Last week, we hosted our first fireside chat at Kindred Ventures in San Francisco. Our CEO, AJ Asver, was joined by Zach Abrams, CEO of Bridge.xyz, the stablecoin startup acquired by Stripe for over $1 billion in less than two years. Zach shared the founding story of Bridge, his vision for the company under Stripe, what excited him about stablecoins, and some hot takes on the San Francisco tech scene.

"The future doesn't just happen. Somebody needs to build it."

– Zach Abrams, CEO of Bridge.xyz

You can watch the full interview below:

The biggest takeaway from the conversation was that while stablecoins are an obvious bet now, two years ago, the space was still very nascent, and that Zach and the Bridge team had to will the market into existence. Early customers discovered Bridge through Twitter and word of mouth, and their first product operated exclusively through Slack without an API, simply by customers requesting that money be transferred. It was amazing to hear how Zach and the team scaled Bridge from those humble beginnings to billions of dollars in transactions and ultimately achieved an exit to Stripe.

Are you heading to Money 20/20 this month?

We will be at Money 20/20 this year with a booth in the startup area and hosting our second Future of Fintech dinner on Tuesday, October 28th at HaSalon. If you would like to join us for dinner, RSVP below!

Want more updates from Parcha?

Keep up with everything we're doing at Parcha by subscribing below!

Or... chat with our CEO and get a live demo of Parcha here:

And don't forget to follow us on LinkedIn

About Parcha

Parcha supercharges compliance teams with AI agents to complete KYC/KYB reviews more accurately and efficiently.

Learn more here 👉 https://parcha.ai

You received this email because you expressed an interest in Parcha. If you don't want to receive more emails from us, feel free to unsubscribe below!